Our Integrated ACCA Prep Program, using the KICN (Knowledge Integrated with Corporate Needs) methodology & led by Industry experts, provides students with the essential Knowledge & practical skills for successful careers in Finance and Accounting

Head Faculty, ACCA

Head Faculty, ACCA

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top Companies Worldwide including Big 4s

Time Taken = 1/2 of Traditional Accounting Programs

More Flexible compared to Indian Accounting Programs

Highly rewarding compared to Indian Accounting Programs

More valuable than a BBA, B.Com, or MBA

Leverage the credibility

of the ACCA Membership

Easily do-able with a continuing college degree

Popularity – 5x Yearly Growth

Develop futuristic

and in-demand skills

High Paying Careers In 180+ Countries

| Offerings | ||

|---|---|---|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Study Exempted Subjects for Free |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Upskilling with Power BI + Financial Modeling + Personal Branding |  |

|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| 3-5 Mock Exams with Detailed Evaluation |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for ACCA Prep Students |  |

|

| Expert ACCA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Internship or

Placement Assistance

Be Qualified While

You Graduate

Personalised Study

Plans

Mock Tests

Interactive Classes

1 - 1 Doubt Session

Personalised Career Counselling

Experienced Faculty

High Passing Rate

Learning Management Software

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

Note: To know examination progression rules, study materials, PER, minimum entry, exemptions, study guides, past examination papers and the ethics module. you can visit (www.accaglobal.com/gb/en/student.html )

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upkilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75+ years

We provide comprehensive career

solutions for both Indian and international

job markets

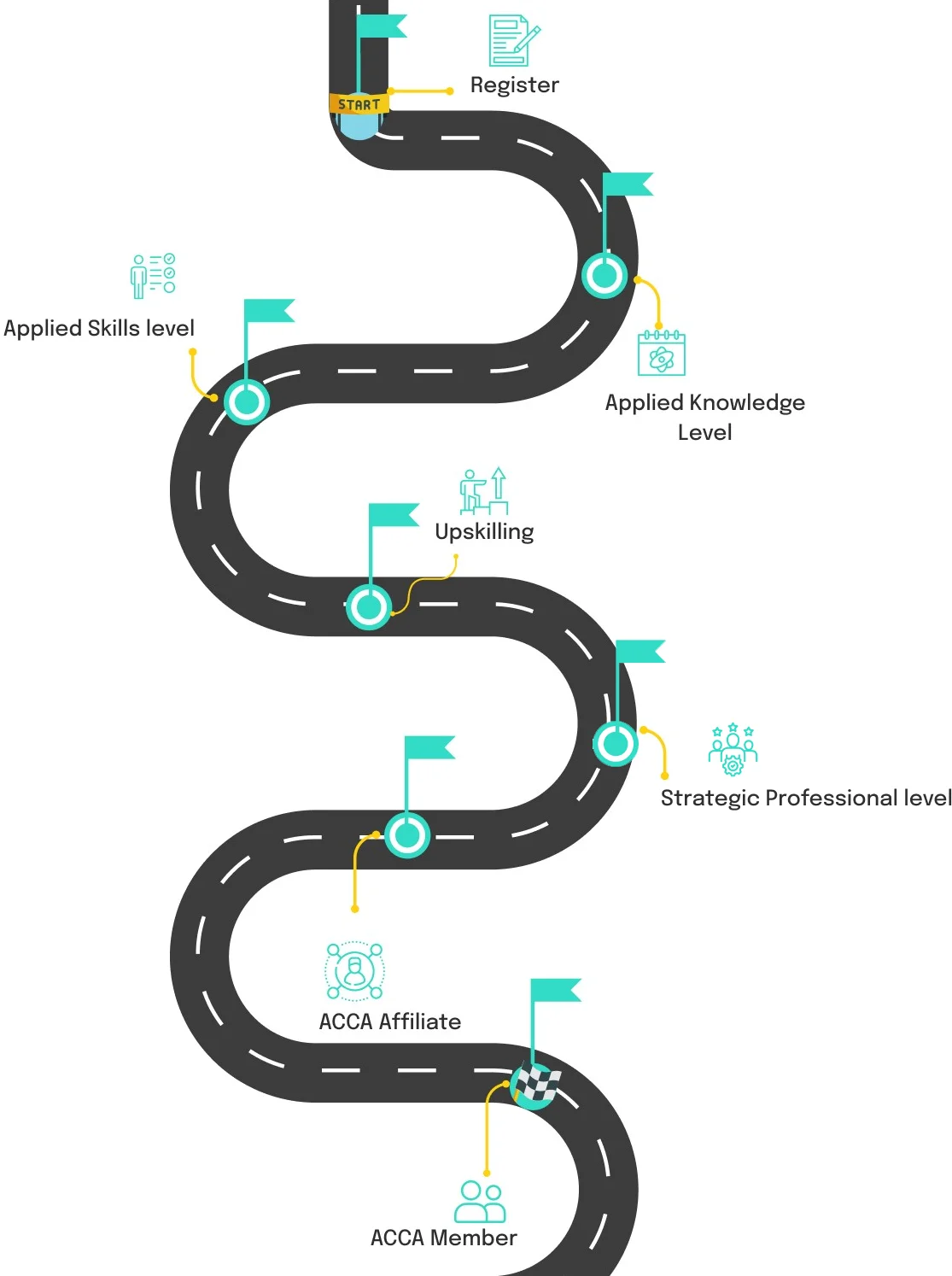

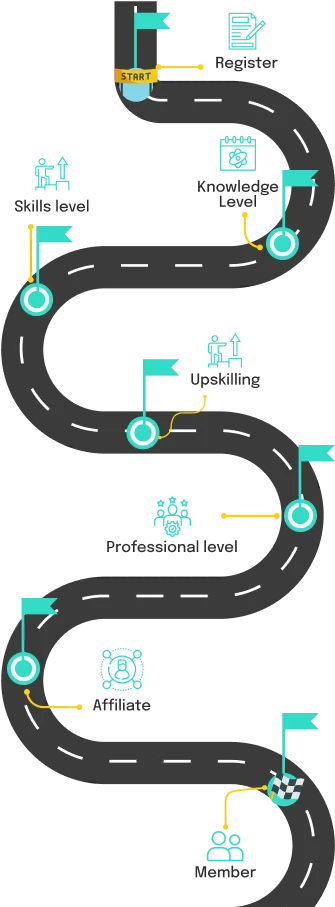

All exams are computer

based

Knowledge Level exams are on demand

ACCA program can be completed in 1-3 years

In a year, a student can take 8 Exams at Max

Skills & Professional Level exams are held 4 times in a year – March, June, Sept & Dec

Upto 13 papers need to be passed by a student out of overall 15 papers

Begin your ACCA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in finance and accounting.

Begin your ACCA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in finance and accounting.

| Offerings |

Weekends / Weekdays |

|

|---|---|---|

| Knowledge Level (KL) (Per Paper) |

Price₹ 24,900 |

Price₹ 19,900 |

| Skill Level (SL) (Per Paper) |

₹ 29,900 |

₹ 23,900 |

| Professional Level (PL) (Per Paper) |

₹ 34,900 |

₹ 27,900 |

| Knowledge Level Plus (KL+) (4 Papers) |

₹ 79,900 (You save ₹19,700) |

₹ 63,900 (You save ₹15,700) |

| Skills Level Plus (SL+) (4 Papers) |

₹ 99,900 (You save ₹19,700) |

₹ 79,900 (You save ₹15,700) |

| Professional Level Plus (PL+) (4 Papers) |

₹ 1,09,900 (You save ₹29,700) |

₹ 89,900 (You save ₹21,700) |

| Placement Services |

₹ 39,900 |

₹ 39,900 |

Note: *IB = Investment Banking

| Particulars |

|

|

|

|---|---|---|---|

| Offline Lectures |

|

|

|

| Lecture Recordings |

|

|

|

| LMS Access |

|

|

|

| Unit & Mock Tests |

|

|

|

| Study Material (Soft Copy) |

|

|

|

| Free Registration Support |

|

|

|

| Placement Assistance |

|

|

|

| Offerings |

Weekends / Weekdays |

|

|---|---|---|

| KL to SL (9 Papers + IB + Power BI + Branding) |

Price₹ 2,29,900 (You save ₹74,100) |

Price₹ 1,99,900 (You save ₹33,100) |

| KL to PL (13 Papers + IB + Power BI + Branding) |

₹ 2,99,900 (You save ₹1,43,700) |

₹ 2,39,900 (You save ₹1,04,700) |

| SL to PL (9 Papers + IB + Power BI + Branding) |

₹ 2,49,900 (You save ₹1,190,000) |

₹ 1,99,900 (You save ₹85,000) |

| PL Plus (4 Papers + IB + Power BI + Branding) |

₹ 1,39,900 (You save ₹19,900) |

₹ 1,09,900 (You save ₹9,900) |

| Placement Services |

₹ 39,900 |

₹ 39,900 |

Note: *IB = Investment Banking

| Particulars |

|

|

|

|---|---|---|---|

| Live Classroom/Offline Lectures |

|

|

|

| Lecture Recordings |

|

|

|

| LMS Access |

|

|

|

| Unit & Mock Tests |

|

|

|

| Study Material (Soft Copy) |

|

|

|

| Free Registration Support |

|

|

|

| Placement Assistance |

|

|

|

Crack Jobs at best finance companies, learn with real work experience and get placed at top finance & accounting based job roles.

Personalized guidance to identify roles that suit your skills and interest

We help you from preparation to final selection

Crack Jobs at best finance companies, leam with real work experience and get placed at top finance & accounting based job roles.

Personalized Guidance To Identify Roles That Suit Your Skills And Interest

We Help You From Preparation To Final Selection

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore numerous career path with the ACCA qualification and also check out the average salary packages.

Salary data has been taken from

Explore numerous career path with the ACCA qualification and also check out the average salary packages.

Salary data has been taken from

₹ 10 – 20 LPA

₹ 5 – 20 LPA

₹ 5 – 12 LPA

₹ 3 – 8 LPA

₹ 9 – 23 LPA

₹ 3 – 10 LPA

₹ 5 – 10 LPA

₹ 5 – 12 LPA

₹ 10 – 35 LPA

₹ 14 – 35 LPA

We provide extensive support, expert guidance, and personalised resources till you pass the exam

We upskill you with Financial Modeling + Power BI + Personal Branding to make you job oriented

Register today to get LMS login & start using our new era platform for all your course needs

We provide extensive support, expert guidance, and personalised resources till you pass the exam

We upskill you with Financial Modeling + Power BI + Personal Branding to make you job oriented

Register today to get LMS login & start using our new era platform for all your course needs

Get in-depth details and information about edZeb’s Integrated ACCA prep program offerings through our brochure.

contact

contact

Delhi is a hub for ACCA coaching institutes, but if you are struggling to find quality coaching, look no further than edZeb, the best ACCA institute in Delhi. As a trusted institute, we offer exceptional coaching, setting you on the path to a successful career in finance and accounting.

The Association of Chartered Certified Accountants, or ACCA in Delhi, is more than just another accounting course or certification; it serves as a gateway to a prosperous global profession because of its demanding curriculum and prestigious reputation. You know, why the ACCA course in Delhi is most popular among students because this course is recognized in more than 180 countries.

We, at edZeb, will help you learn about a wide range of profiles, and numerous high-paying job opportunities that the ACCA course provides in Delhi, India, and abroad when you get on board with us. ACCA Course can be the spark that ignites your career to new heights that you have been aspiring for years.

We understand that looking for top ACCA trainers in Delhi comes naturally since this course is no cakewalk and requires the utmost expertise in terms of knowledge and real-world experience. So, if that was your quest, you have landed on the right platform.

We at edZeb, have been in this industry for years now and our students pass ACCA exams with flying colors.

We at edZeb aim to develop well-rounded finance and accounting professionals with a broad range of skills, not just math whizzes. Here's how we assist our ACCA aspirants in developing an impressive toolkit of skill sets:

We, being the best ACCA coaching in Delhi, pay a lot of emphasis on ethics, equipping you with the skills you need to professionally and morally navigate the complexities of the financial world. When you are on the ACCA journey with us, we aim to keep you ahead of the curve in a time of constant change by providing insights into the current and upcoming trends in the industry. Focusing on ethics and financial trends helps develop skills in ethical decision-making, professional integrity, analytical abilities, technological proficiency, and adaptability.

An additional advantage you get at edZeb, the top ACCA institute in Delhi, will leave you impressed. So, we provide the best ACCA study materials, which we keep handy for our students, and the notes are crafted by our experienced faculty members. These notes have all the required information needed to complete the syllabus. So, overall, other than our ACCA study material, no additional preparation is needed.

We understand that your schedule could be tight. You could be a working aspirant or commuting from your house is not feasible. That's why we offer flexible learning options, including weekend classes, an LMS system, online resources, and recorded lectures, YouTube videos allowing you to balance your studies with other commitments to improve self-discipline and adaptability to various teaching methods and environments.

Our ACCA trainers are easily accessible to cater to the needs of our students. They are result-driven and focus on preparing students to pass with exceptional marks in their ACCA exams. We take pride in the proven track record of our faculty making every possible effort until our students pass their exams. They consistently achieve outstanding results, positioning themselves as leaders in the field of accountancy and finance with the combined efforts of our teachers and faculty.

We recognize that even a small doubt can impact your progress, so our mentors are committed to addressing our students' queries promptly. Whether through call or text, we ensure your questions are resolved quickly, allowing you to continue your studies with confidence. It helps them improve communication skills, time management, and critical thinking.

We have a full-time team and ACCA faculty members who are committed to building a personal connection with every student to guide them personally. Our ACCA trainers have collectively more than 75 years of experience instructing and guiding ACCA Courses in Delhi NCR.

Your ACCA journey at edZeb, the best ACCA coaching institute in Delhi, begins with Akhil Iyer, ACCA, Head of Faculty and CA AIR 34. With over 21 years of experience, he brings a wealth of industry insights from prestigious organizations like Google, American Express, British Council, GE, and EY. Having trained over 10,000 students, he continues to guide a large number of ACCA aspirants with his expertise and dedication.

Akhil Iyer proves to be a great mentor as he lays a strong foundation in the Applied Knowledge Level by teaching ACCA aspirants the intricacies of Business and Technology, Audit and Assurance at the Applied Skills Level, and Strategic Business Leader at the Strategic Professional Level.

Our esteemed ACCA faculty head, Amit Jugia, is a distinguished CA AIR 20, CMA FINAL AIR 4, and CIMA AIR 1. With these accolades and over 21 years of experience, Amit brings invaluable expertise from his tenure at PwC to the classroom. He imparts current industry insights and economic trends through his Taxation lessons, enriching our ACCA students with practical knowledge and up-to-date perspectives.

CA Kapileshwar Bhalla, FCA, with a B.Com (Hons.) from SRCC, Delhi University, and currently pursuing a PhD, has over 25 years of teaching and corporate training experience. A great corporate trainer on IFRS/Ind AS, US GAAPs, and sustainability standards is taking ACCA classes in Delhi for FA, MA, FR, FM, PM, and SBR. He has authored several acclaimed books for CA exams and industry professionals, published by Commercial Law House and Taxmann.

edZeb stands out as the premier choice for ACCA coaching in Delhi, offering a robust foundation in conceptualising and applying key topics from the start. Our expert faculty builds on this strong foundation, providing industry insights, relevant case studies, and practical knowledge. This comprehensive approach ensures that ACCA aspirants are well-prepared to distinguish themselves in the job market, making them highly attractive candidates for top employers and positioning them for a competitive ACCA salary in India compared to their peers.

Our expert career counseling sessions are designed to help students identify their strengths and weaknesses, guiding an effective job search. At edZeb, we recognise the critical role of soft skills, personality, and confidence in securing a successful career in ACCA.

Therefore, we focus on enhancing these key areas to ensure that our students not only excel academically but also present themselves as well-rounded professionals. By honing their communication skills, professional demeanour, and self-assurance, we prepare our students to make a strong impression in interviews and excel in their ACCA careers. In addition to Delhi, you can also contact us if you want to take ACCA coaching in Mumbai.

Our dedicated placement department is headed by Anmol Dhawan with 18+ years of experience placing students in top companies. This department is specially curated to facilitate job placements through our PAN India network and strong alumni connections in the finance and accounting industry. We also help our students secure internships that provide practical experience and enhance their resumes.

Our innovative ACCA training methods include access to industry insights, enhanced understanding, and application of concepts to real-life situations. Moreover, our dedicated Learning Management System (LMS) allows our students to access lectures of interest anywhere anytime. Lastly, they also have the opportunity to attend lectures or seminars by industry experts to have an edge over others in the competitive job market.

Our ACCA training will maximize the chances of your success. Moreover we offer comprehensive coaching, career support, and robust placement assistance to ensure you stand out in the job market and secure competitive salary packages.

Elevate your finance career with edZeb, the leading ACCA coaching institute in Delhi. Our expert faculty, comprehensive study materials, and flexible learning options are designed to help you excel. Benefit from personalized career support, proven placement assistance, and innovative learning methods to secure competitive salary packages and achieve your professional goals. Enroll now in our various programs like CFA, CMA, and Financial Modeling apart from ACCA to start your journey toward success!