CFA Course

- Live Online Classes Available

- Offline Classroom Training in Delhi NCR

- Pre Recorded Course are also Available

- Learn from Industry Experts with Collective Experience of 75+ Years

- The KICN Teaching Methodology Is One of Our Faculty’s Key Strengths

- Our CFA Course starts at ₹17,500/-

- We Offer 100% Placement Assistance

Talk to Our CFA Expert

CFA Course Fees

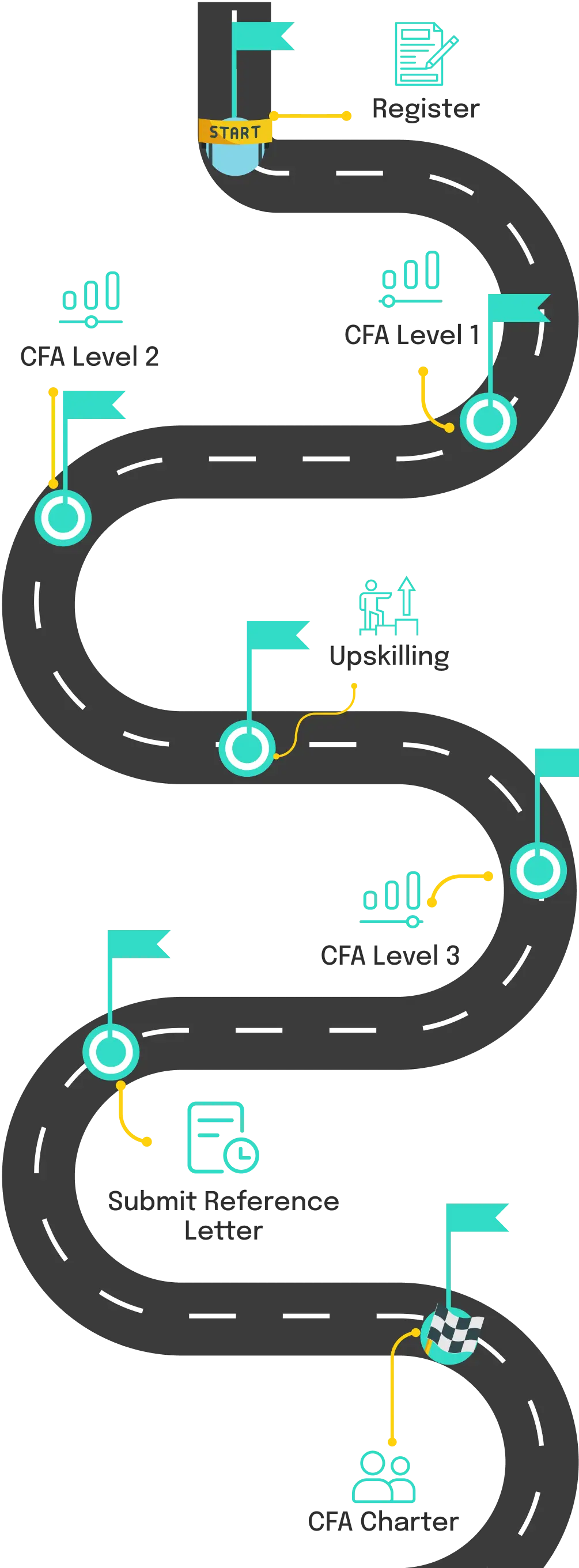

CFA Program Overview

Be the financial mastermind with edZeb and obtain one of the highest distinctions in the world of Finance

CFA

Gold Standard for Finance Professionals

Jobs Available

63,000+.

CFA

Recognized by over 162 countries

Popularity

#1 finance qualification

Eligibility

2nd-Year UnderGraduate

Salary Range

Upto ₹20 Lac

Designation

World's Most Respected Investment Management Designation

Insights & Stories – Our Podcast Series

Watch expert-led videos covering exams, exemptions, salary insights, and career paths.

Know More About the CFA Certification Course

250+

Recruiters PAN India

20,000+

Strong Network Of Alumni

100%

Application-Oriented Programs

90%

Successful Placements

What Our Student's Say

Upcoming CFA Classroom & Live Online Batches

Enroll in our upcoming CFA classes for an interactive, hands-on, and immersive learning experience with top-tier educators and mentors.

Don’t Take Our Word for It

See what our reviews have to say...

.webp)

.webp)