At edZeb, we offer a CFA course in Agra designed to fit your ambitions. With flexible schedules, personalized mentorship, KICN teaching methodology, and career support, we help you ace the CFA exams and step confidently into the finance world.

Watch expert-led videos covering exams, exemptions, salary insights, and career paths.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

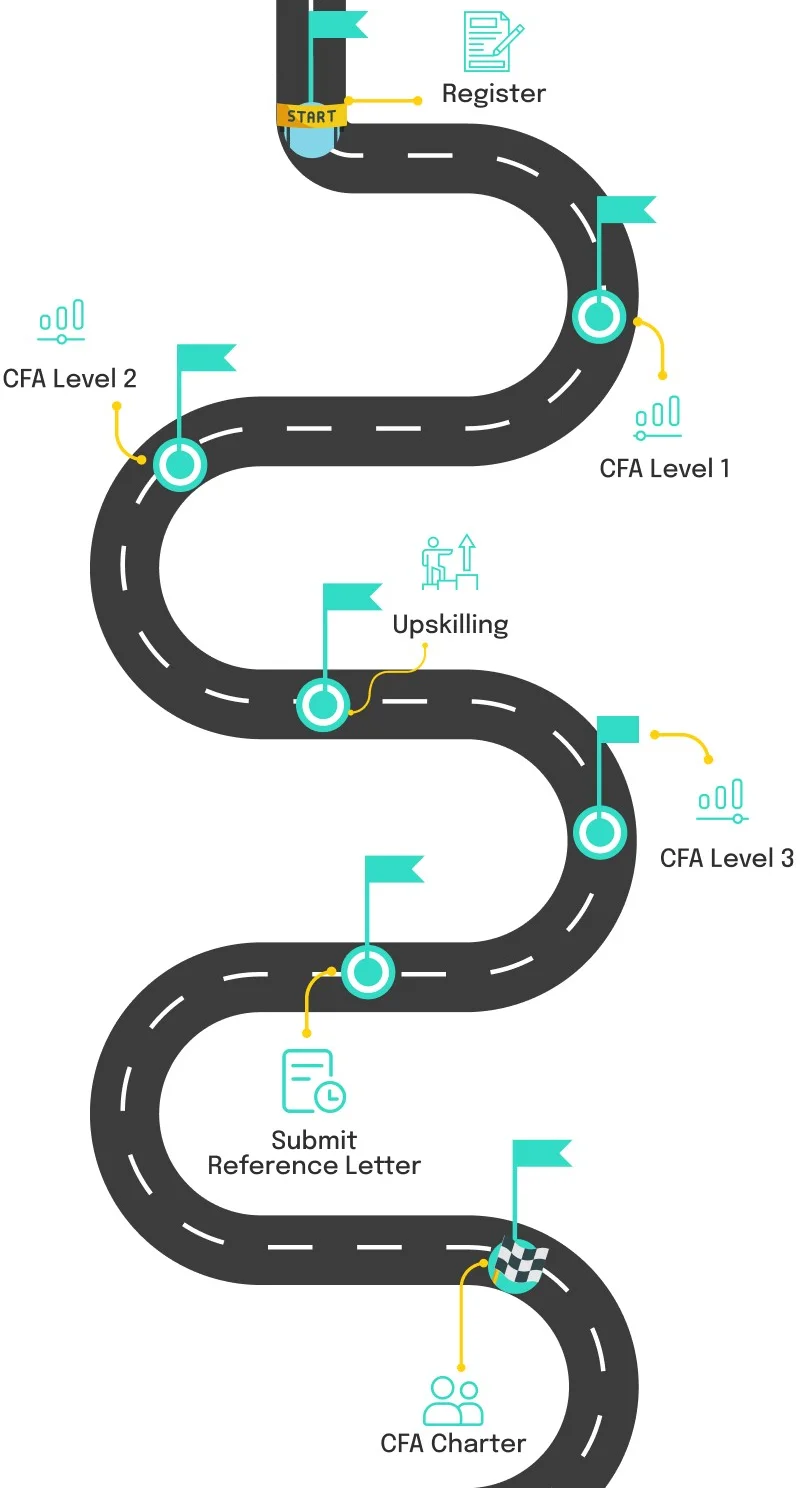

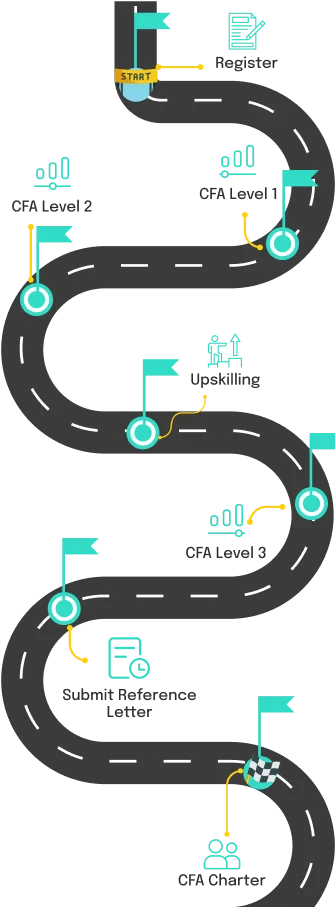

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

(With Doubt Sessions) |

(Without Doubt Sessions) |

|---|---|---|---|

| Level I | Price₹39,900 |

Price₹34,900 |

Price₹30,000 ₹17,500 |

| Level II | ₹39,900 |

₹34,900 |

₹30,000 ₹17,500 |

| Level I+Level II | ₹74,900 (You save ₹4,900) |

₹64,900 (You save ₹4,900) |

₹55,000 ₹32,500 |

| Level I Plus (Level I + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level II Plus (Level II + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level I+Level II Plus (Level I + Level II + IB) | ₹1,09,900 (You save ₹19,800) |

₹90,900 (You save ₹8,800) |

₹85,000 ₹50,000 |

| Placement Services | ₹39,900 |

₹39,900 |

₹39,900 |

*Note: Sales offers will not be available on Pre-Recorded (without doubt sessions) *IB = Investment Banking |

|||

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

Our CFA course in Agra is one of the most recognised among the aspirants. We are known for delivering results, all because of our industry-experienced faculty. The CFA qualification is one of the prestigious finance qualifications in the world. It opens doors to careers in investment banking, portfolio management, equity research, risk analysis, and corporate finance. Students in Agra now have the advantage of preparing for this global certification without moving to big metro cities.

Agra is a city known for its heritage, and it is also becoming a promising place for young professionals who want international careers. With increasing demand for finance professionals, students are now looking for CFA coaching in Agra that offers more than just classroom lectures. They want practical guidance, exam-focused preparation, and career support.

This is where we, at edZeb, stand apart. We are not just a CFA institute in Agra. We are a career partner for students who dream of building strong profiles in the finance industry. Our training focuses on both knowledge and application. Students are guided step by step for exam preparation, and at the same time, they are also prepared for interviews and placements.

We believe that clearing the CFA exam is only the beginning. What truly matters is how students use this qualification to shape their careers. That is why we provide career counselling, placement guidance, and industry exposure to CFA aspirants in Agra. With our 250+ PAN India connections, we also make sure our students are best placed.

The CFA qualification is recognised across the globe as a benchmark for finance professionals. It is not just an academic qualification but a professional standard that proves your ability to work in investment and financial markets.

The scope of CFA in Agra is growing as more and more companies are seeking skilled finance professionals. Students who complete our CFA coaching in Agra can apply for jobs in banks, consulting firms, investment companies, and corporate finance teams. The CFA designation also builds credibility, making it easier to secure opportunities in metro cities and international markets.

The scope is not limited to one role, Students finishing their CFA classes in Agra can explore careers in various fields. These includes investment banking, equity research, portfolio management, wealth management, risk analysis, and corporate finance. Our CFA coaching in Agra is designed in a way that matches the needs of global employers. This means a CFA in Agra can compete for roles not only in India but also in financial hubs such as Dubai, London, Singapore, and New York.

You must also be curious to know the various job roles that you can apply for after completing your CFA classes in Agra, Here is a list of a few of the job profiles:

The investment bankers work with global investment banks on mergers, acquisitions, capital raising, and advisory projects. This role is a high-pressure job but also one of the most rewarding in terms of pay and exposure.

The equity research analysts are supposed to analyse companies, industries, and market trends. They prepare detailed reports to guide investors and fund managers in making smart decisions. This role is perfect for those who enjoy research and market analysis.

Portfolio manager, are responsible for managing investments for individuals, institutions, or funds. They decide where to invest money for the best balance of risk and return. Portfolio managers are among the highest-paid professionals in finance.

Wealth managers work with high-net-worth clients to plan and grow their wealth. Their role includes advising on investments, tax planning, and long-term financial strategies.

Risk analysts identify and manage financial risks for banks, corporates, or investment firms. They are in demand due to the rising importance of compliance and risk management.

Corporate finance professionals work in the finance teams of large companies. They handle activities like budgeting, forecasting, financial planning, and strategic investment decisions.

Fund managers oversee mutual funds, hedge funds, or pension funds. They make decisions on where to allocate assets to achieve the best performance for investors.

Financial consultants work independently or with consulting firms. They provide expert advice to businesses or individuals on investments, restructuring, or financial planning.

All the above-mentioned profiles are now within reach of students who complete their CFA coaching in Agra. With our expert coaching, aspirants not only prepare for the exams but also learn how to apply for these roles and present themselves as strong candidates in interviews.

Another important part of our CFA course is its focus on ethics and practical knowledge. Employers trust the charterholders because they combine strong financial skills with professional values. This creates better career growth and long-term stability.

The global finance industry is changing fast. Multinational companies are looking for professionals who can handle complex investment decisions with skill and integrity. Our CFA course in Agra prepares students exactly for these demands. Here is a list of industries hiring CFA professionals:

In India, the demand for CFA professionals is expected to rise as more foreign investment flows into the country in Agra, this creates an opportunity for students to prepare locally and later explore roles in Delhi, Mumbai, Bangalore, or even abroad.

Salary is also one of the main reasons that students choose the CFA coaching in Agra. CFA charterholder is valued across industries, which is reflected in higher salaries compared to regular finance graduates. The list below is to give you an idea of the earnings after completing our CFA course in Agra.

This salary growth shows how CFA can transform the financial career of students from Agra. Pursuing CFA is your chance to stand out; unlike regular finance degrees, CFA offers specialisation in investment and market-related fields. This makes candidates more valuable in a competitive job market. We guide our students on how to connect their CFA learning with real job requirements, giving them an edge during placements and interviews.

The quality of faculty is the most important factor in CFA preparation. At edZeb, the a renowned CFA Institute in Agra, students get the chance to learn under some of the most experienced mentors in India. The guidance covers the theory, practical insights, and industry applications.

The lead mentor for our CFA coaching in Agra is CA Vikas Vohra. He is one of the most respected CFA faculty members in the country. His teaching style is simple, clear, and focused on real-world application. Thousands of students across India have been prepared under him, and many have cleared their exams successfully.

CA Vikas Vohra is not just an academic teacher. He has years of corporate experience in finance. This allows him to explain concepts with practical examples. Students in Agra benefit from his ability to connect topics with real business scenarios.

Under his mentorship, students receive subject knowledge. They also learn how to think like finance professionals. This makes preparation strong and career-oriented. His approach reduces exam fear and builds confidence step by step.

Apart from CA Vikas Vohra, we also have a team of skilled faculty members and industry trainers. They conduct regular doubt sessions, practice classes, and mock exams. Every student gets personal attention because we keep batch sizes small.

In Agra, where access to top mentors was once limited, we now make expert training available to all CFA aspirants. With the right guidance and mentorship, students can achieve their dream of becoming CFA charterholders and step confidently into global finance careers.

Choosing the right institute is the most important step in your CFA journey. Students now have access to our best CFA coaching in Agra. We are a trusted name for professional finance coaching. What makes us different is the way we combine expert mentorship, modern learning tools, and career-focused training. Here are some of the features that set us apart:

Our students learn under the guidance of CA Vikas Vohra. He is a well-known CFA mentor in India. His teaching is simple and practical. He explains every concept with examples from the finance industry. Students in Agra benefit from his years of corporate and teaching experience. His mentorship gives them both confidence and clarity.

We follow the KICN teaching approach. This means we do not limit learning to only books. Every topic is connected with its use in real finance roles. Students learn how concepts apply in investment banking, equity research, and corporate finance. This makes preparation more relevant and career-oriented.

Our LMS is designed to support students at every step of their CFA journey. It includes recorded lectures, study notes, quizzes, and mock tests.This allows students to revise anytime and anywhere. The LMS also has a doubt forum where queries are solved quickly. For CFA aspirants in Agra, this system makes learning flexible and stress-free.

We keep our batch sizes small. This ensures every student gets personal attention. Regular doubt-solving classes are conducted so that no topic remains unclear. Mentors track progress and guide students individually. This personal support is very useful during CFA exam preparation.

We prepare students for the actual exam environment. through regular mock tests and exam-style practice papers. This helps students improve time management and accuracy. By the time they sit for the CFA exam, they are fully confident.

At edZeb, the trusted CFA institute in Agra, we believe that the most coveted credential is not just about passing exams. It is about building a career. Students are guided on resumes, interview skills, and job applications. Our mentors also connect students with industry professionals. In Agra, this support gives CFA aspirants a strong edge in placements. With all these features, we have become the preferred choice for CFA coaching in Agra. We provide complete support, from the first class to the final placement.

Our CFA coaching classes in Agra are your pathway to a global career in finance. Students no longer need to compromise on quality coaching or mentorship. With edZeb, you get expert guidance, structured preparation, and complete career support under one roof. Thus, making it the best CFA institute in Agra for students as well as professionals alike.

Our focus is not only on helping you clear the CFA exams but also on preparing you for real-world finance roles. With mentorship from CA Vikas Vohra, advanced learning tools, and career-oriented training, we make sure every student is ready for both exams and opportunities.

If you are planning to pursue CFA in Agra, this is the right time to begin. Take the first step towards your dream career with us today.

Contact us now to learn more about our CFA classes in Agra and start your journey to becoming a CFA charterholder.