Fulfill your career dreams with edZeb’s CFA coaching in Noida. Our expert mentors, practical learning, and placement assistance ensure that you are fully prepared for your exams and future opportunities. With flexible classes and real-world insights, we help you build a strong foundation for a thriving career in finance.

Watch expert-led videos covering exams, exemptions, salary insights, and career paths.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

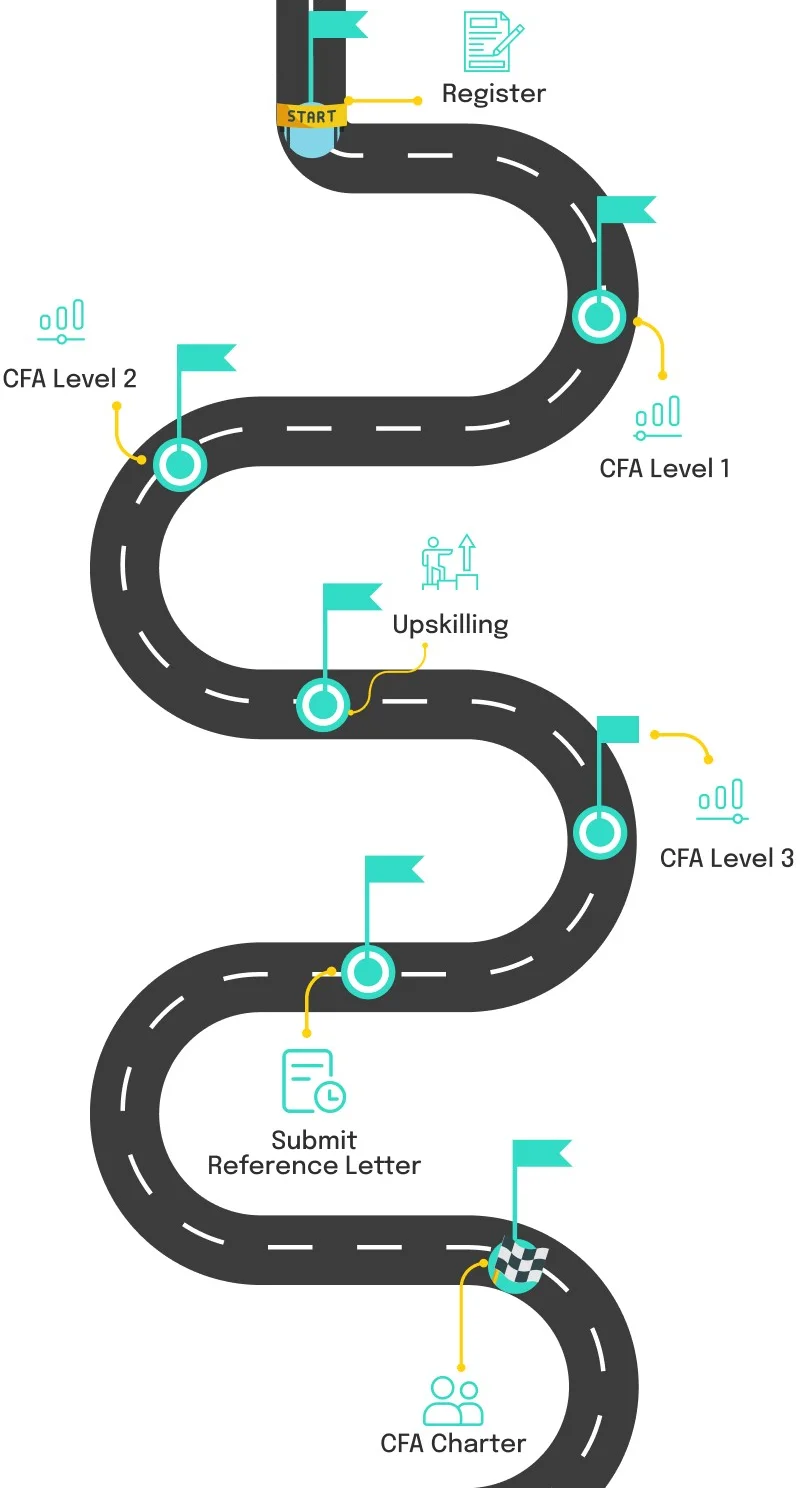

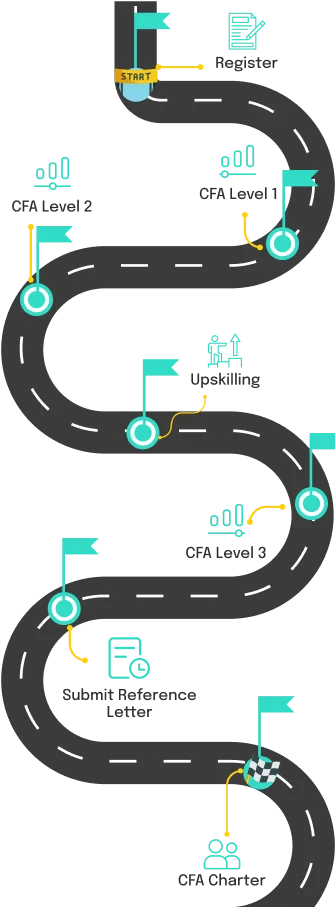

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

(With Doubt Sessions) |

(Without Doubt Sessions) |

|---|---|---|---|

| Level I | Price₹39,900 |

Price₹34,900 |

Price₹30,000 ₹17,500 |

| Level II | ₹39,900 |

₹34,900 |

₹30,000 ₹17,500 |

| Level I+Level II | ₹74,900 (You save ₹4,900) |

₹64,900 (You save ₹4,900) |

₹55,000 ₹32,500 |

| Level I Plus (Level I + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level II Plus (Level II + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level I+Level II Plus (Level I + Level II + IB) | ₹1,09,900 (You save ₹19,800) |

₹90,900 (You save ₹8,800) |

₹85,000 ₹50,000 |

| Placement Services | ₹39,900 |

₹39,900 |

₹39,900 |

*Note: Sales offers will not be available on Pre-Recorded (without doubt sessions) *IB = Investment Banking |

|||

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

If you are thinking of a career in finance, then the CFA coaching in Noida is one of the best choices you can make. And now, with edZeb’s CFA course, you can take that leap you were waiting for to make it easier or more convenient.

Since Noida is quickly becoming a top destination for students and young professionals. It is home to many multinational companies, start-ups, and financial firms setting up here. The city is full of career opportunities, especially in finance and investment. That is why learning CFA in Noida from edZeb just makes sense because we understand what today’s students need. Our CFA coaching in Noida is built to match your pace, your schedule, and your goals.

Our CFA course is clear, practical, and supportive. You get full access to study materials, regular mock tests, and doubt-solving sessions. But more than that, you get a mentor who cares about your progress and stays with you till the end. We have already helped 10,000 plus students gain confidence and pass their CFA exams. Now they have stepped into great finance roles and we are ready to do the same for you.

So, it is our call to you all living in Noida and want to prepare for CFA in a smart yet effective way, rest assured, Our CFA Institute in Noida is here to help. If you have the right guidance and a friendly learning environment, the dream of becoming a CFA is just on the horizon.

So, it is your turn to make a wise decision today. Contact our career consultant to book a demo class to start your journey with edZeb.

At our CFA Institute in Noida, edZeb, we know that the CFA journey is not just about passing exams. It is truly about understanding the subject, building confidence, and preparing for real-world finance roles. That is why we have shaped our CFA coaching in Noida around what students actually need, like clarity, support, and career direction, rather than just theory.

At edZeb, we do not believe in one-size-fits-all teaching. We believe in building your confidence, step by step, with the kind of support that lasts beyond the classroom. When you join our CFA Course in Noida, you are not just joining a CFA batch, but you are joining a community that wants to see you succeed.

With result-oriented coaching and the best CFA training, edZeb also offers the best offline and online CFA course in Mumbai, Pune and many cities of India to set your direction and skills needed to land a top accounting job in India and abroad.

At edZeb, we believe that only the right guidance can transform your journey. That is why we are proud to have CA Vikas Vohra as our lead mentor in the CFA classes in Noida. With over a decade of experience in both the finance industry and education, he brings a wealth of knowledge and passion for teaching that resonates with every student.

CA Vikas Vohra is a Chartered Accountant and he has also cleared the CFA Level II. He has had a distinguished career at well-known Bajaj Finance, ICRA, and Ernst & Young (EY). Such an edifice of experience has embedded within him a substantive framework to practice financial analysis, devise investment strategies, and apply CFA concepts.

His unique student-focused approach makes him different from other mentors, rather than a mere teacher in the traditional sense. He simplifies tough concepts while making them relevant through real-life examples that his students can relate to. He makes sure that every student has completely understood the material. His personal devotion to his students' successes is revealed in his willingness to resolve any doubts they may have and to assist them personally.

Over the years, CA Vikas has mentored more than 10,000 students across India. His ability to connect with students and make learning engaging has earned him a reputation as a trusted mentor in the CFA community.

You can reach out to our expert team of counsellors, who will guide you to navigate through our CFA course in Noida. They will also assist you in resolving all your queries related to CFA classes in Delhi, Gurgaon, and many more centres of India.

The CFA (Chartered Financial Analyst) certification is one of the most prestigious qualifications in the world of finance and investment. Once you complete the CFA course in Noida, The CFA designation opens doors to diverse career opportunities globally, so every candidate will have his own reasons for applying for this credential. Professionals from various educational backgrounds choose to pursue the CFA - some after completing their bachelor's degree like B.Com, BBA, BBS, many do CFA after CA, so it opens up numerous career opportunities across various sectors.

So, let us explore more about the CFA career prospects:

After completing CFA Level 1 or Level 2, you will find a range of entry-level roles, including:

S. No. |

Entry-Level Career Roles |

Key Responsibilities |

|---|---|---|

| 1 | Research Analyst | Analyse market trends, industries, companies, and financial products to guide investment decisions. |

| 2 | Financial Analyst | Handle budgeting, forecasting, and financial planning; analyse financial statements and support decision-making. |

| 3 | Credit Analyst | Assess creditworthiness of individuals and organisations; evaluate financial risk in lending. |

| 4 | Investment Banking Analyst | Support senior bankers with mergers, acquisitions, IPOs; conduct financial modelling and market research. |

Once you have cleared CFA Level 2 or Level 3, you will be ready to transition into mid-level roles with more responsibility and higher pay. These roles include:

S. No. |

Mid-Level Career Roles |

Key Responsibilities |

|---|---|---|

| 1 | Portfolio Manager | Manage investment portfolios for clients; focus on asset allocation, risk management, and investment strategy. |

| 2 | Risk Manager | Identify, assess, and mitigate financial and operational risks in organisations. |

| 3 | Fund Manager | Oversee investment funds; Make decisions based on economic analysis, market trends, and Security evaluations. |

| 4 | Financial Consultant | Provide financial advice on retirement, Investments, Tax planning; Create personalized financial plans |

After becoming a CFA Charterholder, you can step into senior leadership roles. These roles not only require a thorough understanding of finance but also the ability to lead teams, manage large portfolios, and make high-stakes decisions.

S. No. |

Senior-Level Career Roles |

Key Responsibilities |

|---|---|---|

| 1 | Chief Investment Officer (CIO) | Sets overall investment strategy, Manages large investment teams, Decides asset allocation and oversees portfolio performance |

| 2 | Head of Research | Leads research teams, Provides market intelligence, Ensures quality research output and Develops data-gathering strategies |

| 3 | Senior Portfolio Manager | Manages large portfolios (multi-million/billion-dollar), Oversees investment products and Makes high-stakes investment decisions |

CFA professionals are in high demand by leading financial institutions.

Some of the top companies that hire CFA professionals include:

Salaries for CFA professionals in India vary significantly depending on their experience, the level of CFA certification, and the specific job role. Here’s a rough idea of salary expectations at different stages:

At edZeb, we are passionate about helping you succeed in your CFA journey. Whether you’re just starting with CFA Level 1 or advancing to Level 2, our expert guidance and personalised approach ensure you are always on track. With our practical teaching methodology, you will be fully prepared to tackle any challenge and seize every opportunity in the world of finance.

Our CFA coaching in Noida is not just about clearing the exams; it's about entering a finance career prepared with the knowledge, skills, and confidence to thrive on a global basis. A team of seasoned instructors, flexible learning modes, and round-the-clock support—these are all here to help you achieve your ultimate goals.

Do not let anything keep you from being a CFA Charterholder. The opportunities that the finance sector brings are boundless, and with our CFA course in Noida you will have the mentorship, resources, and support that will see you through this journey.