Turning ambitions into global victories.

Fulfill your career dreams with edZeb’s CFA coaching in Lucknow. Our expert mentors, practical learning, and placement assistance ensure that you are fully prepared for your exams and future opportunities. With flexible classes and real-world insights, we help you build a strong foundation for a thriving career in finance.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

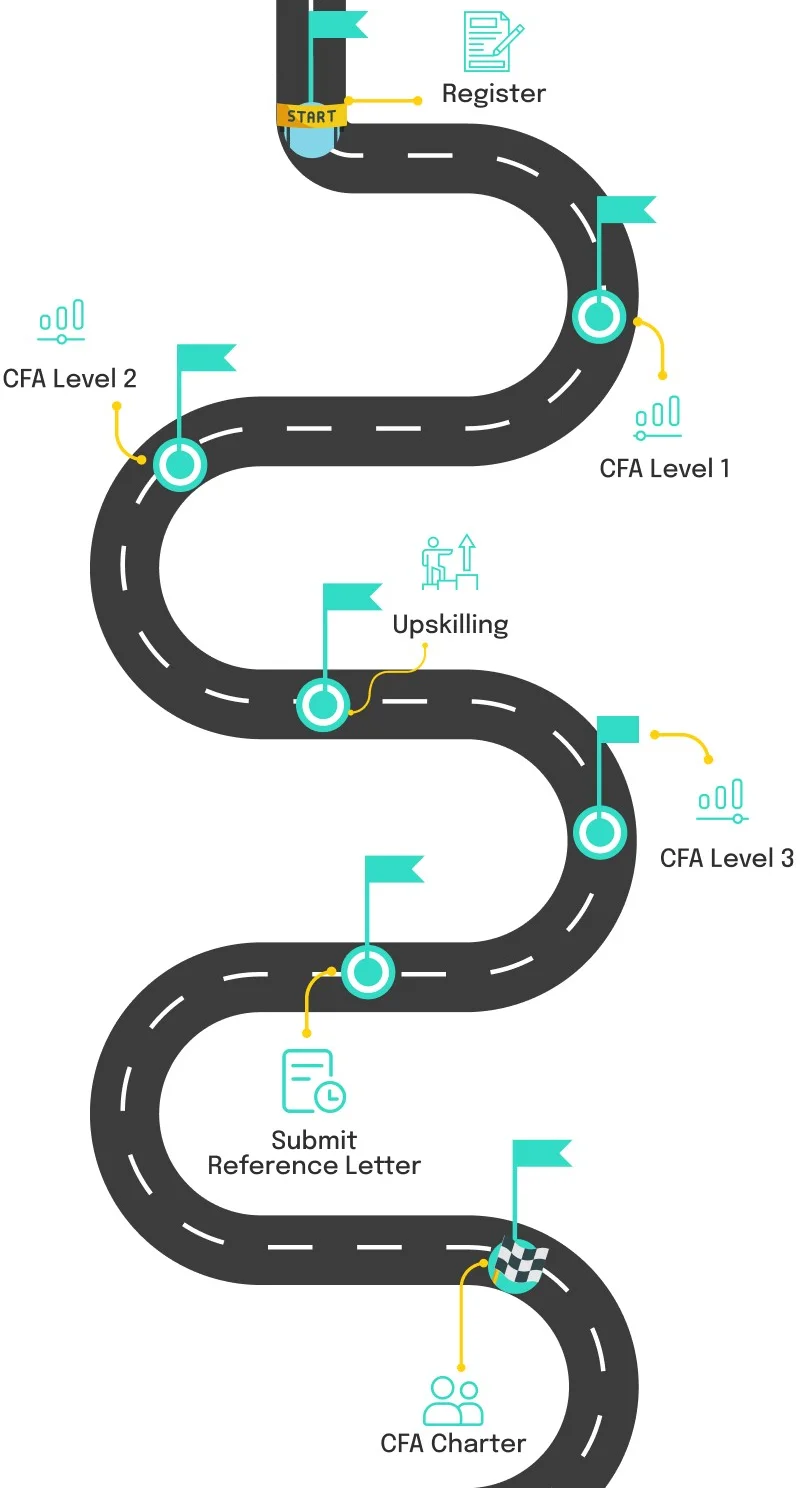

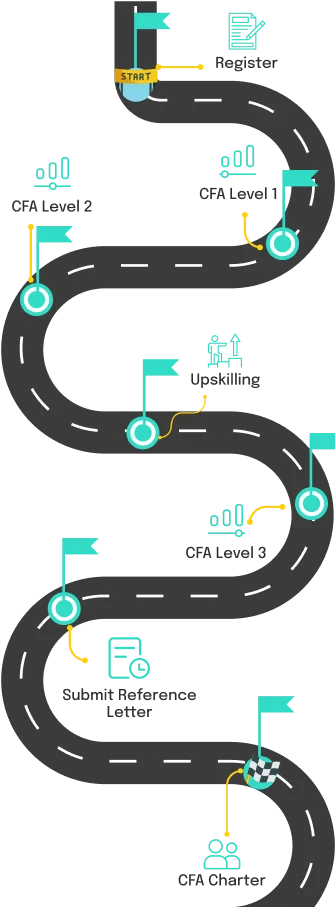

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Level I | Price₹ 39,900 |

Price₹ 34,900 |

| Level II | ₹ 39,900 |

₹ 34,900 |

| Level I+Level II | ₹ 74,900 |

₹ 64,900 |

| Level I Plus (Level I + FM) | ₹ 79,900 |

₹ 69,900 |

| Level II Plus (Level II + FM) | ₹ 79,900 |

₹ 69,900 |

| Level I+Level II Plus (Level I + Level II + FM) | ₹ 1,09,900 |

₹ 99,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

A fast-evolving financial sector calls for increasing analytical magic by professionals. If you are also thinking of something big to accelerate your career in finance then our CFA coaching in Lucknow is able to open your doors for global opportunities. Our CFA course is not only internationally recognized, but it is also one of the most honoured credentials in the finance industry.

However, being a CFA charterholder is certainly not easy. Tough exams have to be passed which require clear conceptual clarity along with a strategic study approach in order to achieve it. This is where edZeb's CFA coaching in Lucknow changes the game.

At edZeb, we understand that the preparation for CFA course is not meant just covering the syllabus, but rather mastering the financial concepts, problem-solving skills, and motivation all through this journey. Whether you are a recent graduate or a working professional, edZeb offers flexible learning options, including classroom and online sessions, to suit your schedule. Our goal is to help you clear your CFA exams with confidence and build a successful career in finance.

Indeed, Lucknow has become an educational hub. It attracts students from all corners to provide them with all these resources and professional courses. Only until recently, however, students in Lucknow had to resort to self-study or online courses for tackling CFA. If you are wondering, is CFA worth it? The answer lies in its growing reputation as one of the most sought-after qualifications in the finance sector. Now, with edZeb expert-led CFA classes in Lucknow, you can get to learn under the right guidance, structured learning, and a strong support system within the confines of your own city.

Join edZeb’s CFA course in Lucknow and take the first step toward becoming a confident finance professional who stands out in the global market. You can get in touch with our expert counsellors to know more about course-related queries, including the CFA scholarship, exams, study material and more.

Preparing for the CFA exams is quite a Herculean task. With a vast syllabus and intricate concepts plus an exam that tests candidates on knowledge and analytical prowess, the difference lies in one's choice of coaching institute. edZeb stands for more than lectures; it puts you through a structured learning experience that offers you a fair chance at success.

Here are the reasons edZeb is the best choice for CFA course in Lucknow:

Teaching quality is important for CFA preparation. At edZeb, CFA aspirants study under the expert guidance of CA Vikas Vohra. Even the rest of the faculty members except the co-founders are all charterholders and faculty with industry exposure. They teach both theory as well as its applications in investment banking, portfolio management, and risk analysis. This practical approach to teaching enhances the learning experience with relevant examples.

A lot of CFA aspirants face problems in managing time and retaining concepts. At CFA coaching in Lucknow, we provide them with the best study materials, short notes for revisions, and a question bank focused on the exam. Our regular mock tests replicate CFA exam conditions to help students gain confidence and perfect their strategies.

Every student has his or her way of learning. That is why we never drain our energy on generic online courses. Our personalized guidance ensures that every student receives individual attention. Since we have one-on-one doubt solving sessions, issues concerning difficult topics are solved so that you would never feel lost or burdened.

We realize that CFA candidates of different backgrounds are students, while others are working professionals balancing jobs with studies. Thus, we offer both maintained and online learning options. edZeb got you covered whether you want to attend CFA classes in Lucknow or learn from home.

The success of our students is enough testimony. Many CFA aspirants under edZeb have cleared Level 1 and Level 2, with commendable scores, earning positions in leading financial firms. We take pride in our result-driven approach, which ensures that our students are always ahead of the curve in their CFA journey.

We at CFA Institute in Lucknow do not prepare for exams alone but prepare for your finance career as well. Our students also have access to campus recruiting sessions, career development workshops, and resume-writing sessions to create opportunities for roles in investment banking, asset management, or financial analysis.

You can also consider our other centers for CFA course in Mumbai, Kolkata, and Chennai to ace your skills for the fast-growing accounting industry.

At edZeb, we strongly believe that it is a good mentoring that makes a great difference in preparing for the CFA exams. That is why we have CA Vikas Vohra, an industry veteran justifying years of real-world finance expertise and academic excellence with our CFA course in Lucknow.

Our expert-led CFA coaching in Lucknow is conducted by CA Vikas Vohra. He is one of the Co-Founder & CFO at edZeb. Along with CA, he has also cleared CFA Level II. His first career innings started with Bajaj Finance, ICRA & EY. After this, he developed a passion for teaching, and in his 10+ years of teaching experience has trained 10,000+ students being appointed in PAN India.

CA Vikas Vohra is a person with immense potential in the field of finance. He has relevant experience in corporate finance, investment analysis, risk management, and financial modelling. Having spent sufficient time in the industry, he understands the problems faced in the real financial world and shares practical knowledge in all his classes. His knack for simplifying difficult CFA terms into simple, real-life applications makes him well-liked among students.

With hands-on experience in finance, investments, and corporate advisory, CA Vikas Vohra ensures that our students not only qualify for CFA examinations but also acquire practical financial expertise.

He ensures simplification of such complex topics as derivatives, portfolio management, and equity valuation using real-life case studies, financial models, and examples from the market.

CFA becomes very challenging for the students, but with one-on-one mentoring sessions, doubt-solving classes, and strategic study plans, our students feel confident and well-prepared.

CFA examinations focus beyond knowledge and understanding- they are a marriage of cunning examination techniques, time management, and well-structured review plans. According to CA Vikas's methodology, students will develop the strategy needed to win.

Career Consulting, Network Building, Job Placement; His mentoring transcends the classroom toward maximum student benefit from the CFA qualification.

At edZeb, we also deliver offline and online CFA classes in Delhi from top industry experts to enhance your finance career to new heights.

Earning the Chartered Financial Analyst (CFA) certification is one of the best economic career decisions a person can take. It is internationally recognised and offers openings into the most lucrative jobs in investment management, banking, consulting, and corporate finance.

The CFA turns even more productive since it has much more versatility; it is not just for analysts; it is for anyone wanting to build a great lifetime career in finance.

Here’s a closer look at the career opportunities after completing the CFA qualification:

Almost every CFA charterholder is interested in having a career as an investment banker. CFAs have to do mergers and acquisitions, corporate financing, and IPO advisory along which they help businesses to raise capital and make strategic investment decisions. Investment banks highly value their candidates because of their strong understanding of financial modelling, valuation techniques, and risk management.

So, the salary of investment bankers in India varies from ₹12-25 LPA (varies with experience and firm) but they earn $90,000-$200,000 per annum in bigger financial hubs like New York, London, and Hong Kong.

A portfolio manager works for an investment fund while managing customer assets to generate the best returns with the least risk. A CFA certification provides an in-depth understanding of asset allocation, equity research, and fixed-income investments. That's why charterholders become very suitable for this role. Most of the CFAs end up managing hedge funds, mutual funds, and pension funds.

Their salary in India ranges between ₹10-30 LPA (higher for senior roles) and globally $80,000-$250,000 per year (top hedge fund managers earn millions).

If you enjoy analyzing financial statements, studying market trends, and making stock recommendations, equity research could be a perfect fit. Equity analysts evaluate companies and advise investors on buying or selling stocks. The CFA curriculum in our CFA institute in Lucknow covers financial statement analysis, valuation techniques, and corporate finance, making it an ideal certification for this role.

They earn ₹8-20 LPA (entry-level to senior roles) in India and $70,000 - $150,000 per year globally.

Every financial institution needs professionals who can assess and mitigate risks. CFA charter holders often work as risk analysts, credit analysts, or chief risk officers (CROs), helping firms minimize financial losses. With expertise in derivatives, fixed income, and risk assessment, CFA holders are well-equipped to excel in this field.

Their salary compensation in India is ₹10-18 LPA and the global salary of these professionals is $80,000 - $180,000 per year.

Many CFA charter holders become financial advisors, helping individuals and institutions manage their wealth. This role involves designing investment portfolios, tax planning, estate management, and retirement planning. High-net-worth individuals (HNWIs) and corporate clients prefer CFA-qualified advisors due to their deep knowledge of investment strategies.

They earn ₹8-22 LPA in India and $75,000 - $200,000 per year globally.

Multinational corporations (MNCs) and large enterprises require financial experts to manage their capital, optimize cash flows, and plan long-term strategies. CFA charter holders work in roles like corporate financial analysts, treasury managers, and CFOs, ensuring businesses make sound financial decisions.

In India, their salary ranges ₹12-25 LPA and globally $80,000 - $180,000 per year.

With high salaries, global recognition, and diverse career opportunities, CFA remains one of the best certifications for finance professionals. If you are in Lucknow and looking to kickstart your CFA journey, edZeb’s expert CFA coaching in Lucknow will help you crack the exams and land a high-paying finance job.

CFA is considered the gold standard in the financial industry and opens doors to some of the highest-paid jobs in investment banking, portfolio management, risk analysis, and corporate finance. However passing the CFA exams will need expert mentorship, a structured approach to preparation, and continuous motivation.

We at edZeb conduct comprehensive training and courses for CFA coaching in Lucknow, under the mentorship of CA Vikas Vohra, a well-known industry veteran with profound qualifications in finance and investment. Personalized mentorship, great study resources, and a study approach with many options facilitate our students to pass exams while acquiring hands-on experience for a robust career.

Whether you are a new graduate or a working professional. So wait no more, enroll right now in our CFA course in Lucknow, and get started on your journey toward an extraordinary career in finance.