Fulfill your career dreams with edZeb’s CFA coaching in Surat. Our expert mentors, practical learning, and placement assistance ensure that you are fully prepared for your exams and future opportunities. With flexible classes and real-world insights, we help you build a strong foundation for a thriving career in finance.

Watch expert-led videos covering exams, exemptions, salary insights, and career paths.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

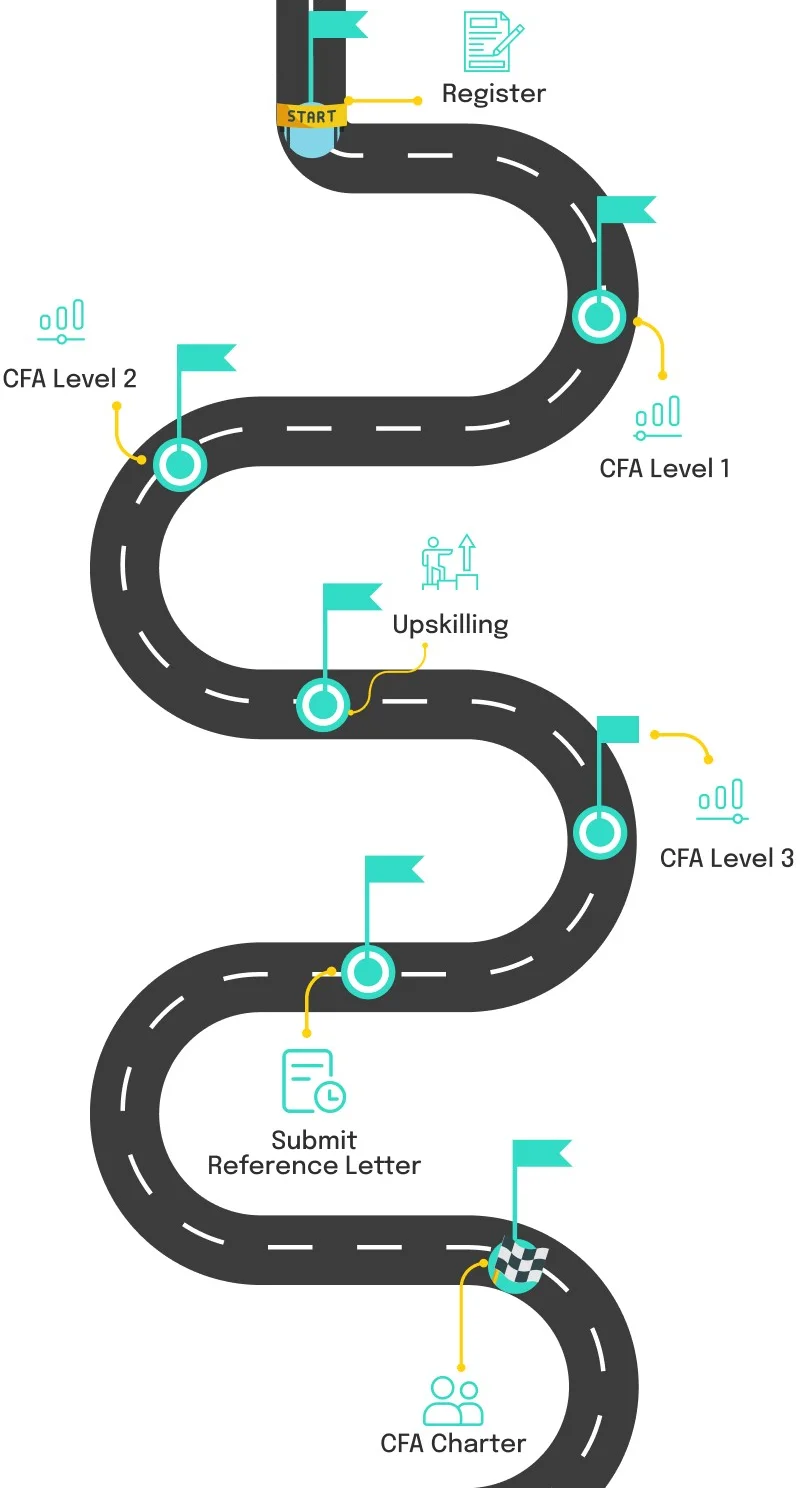

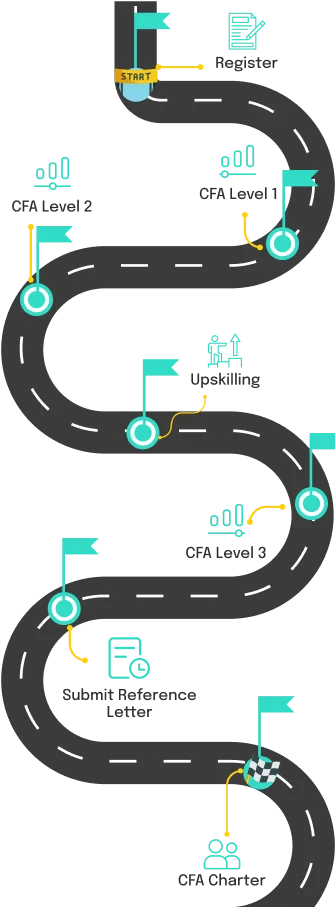

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

(With Doubt Sessions) |

(Without Doubt Sessions) |

|---|---|---|---|

| Level I | Price₹39,900 |

Price₹34,900 |

Price₹30,000 ₹17,500 |

| Level II | ₹39,900 |

₹34,900 |

₹30,000 ₹17,500 |

| Level I+Level II | ₹74,900 (You save ₹4,900) |

₹64,900 (You save ₹4,900) |

₹55,000 ₹32,500 |

| Level I Plus (Level I + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level II Plus (Level II + IB) | ₹79,900 (You save ₹9,900) |

₹69,900 (You save ₹14,900) |

₹60,000 ₹35,000 |

| Level I+Level II Plus (Level I + Level II + IB) | ₹1,09,900 (You save ₹19,800) |

₹90,900 (You save ₹8,800) |

₹85,000 ₹50,000 |

| Placement Services | ₹39,900 |

₹39,900 |

₹39,900 |

*Note: Sales offers will not be available on Pre-Recorded (without doubt sessions) *IB = Investment Banking |

|||

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

We at edZeb are introducing the best CFA coaching in Surat, India’s diamond and textile hub. It is now emerging as a growing financial and business center. With increasing opportunities in the accounting and finance industry, the demand for skilled financial professionals is also at an all-time high. If you aspire to build a rewarding career in finance, the (Chartered Financial Analyst) CFA course is your ideal choice.

The CFA designation is respected globally. It prepares people with acumen in investment management, financial analysis, and ethical decision-making. All these essential skills that huge financial firms look for in a professional. That means, whatever category you fit in as a student, working professional, or finance enthusiast, CFA is going to pour high-paying jobs in India and abroad for one and all from Surat.

edZeb is, therefore the top CFA institute in Surat that provides an expert-led coaching program. It was deemed by being one of the most renowned institutes that allows aspiring students of finance to gain success through dedicated structured learning, exam-oriented training, and complete mentorship to enable passing exams with confidence.

Through our industry-experienced faculty, a practical learning approach and career support, one receives much more than just exam preparation; you get yourself a launchpad for success in global finance.

Our CFA course in Surat provides a globally recognized certification in the finance industry. The CFA certification is well-recognized for offering vast career opportunities all across the globe. Our CFA Institute provides quality teaching so that you gain the charter after clearing prerequisites, exams, and relevant experience.

We understand that CFAs are in high demand due to their expertise and global perspective. In turn, this prestigious certification enhances career prospects and establishes professionals as leaders in the finance industry, enabling higher packages at various job profiles. The demand for CFA charter holders is also strongly demanded among top employers in India. According to the data from the CFA Institute career website and other leading job portals CFAs earn 50K per month and more with experience. Read further to have a look at various job profile and their respective salary packages offered to them.

Portfolio managers are people who make investment decisions. They design and implement investment strategies and processes that are aimed at satisfying client goals and constraints, build and manage portfolios, and decide what and when to buy and sell investments. A portfolio manager earns an average salary of ₹ 19 lacs per annum in India.

Research analysts undertake extensive data collection and investigative analysis to give actionable recommendations. They explore numerous data sources and interpret complex analyses to lend support to decision-making. The average annual salary for research analysts in India is ₹ 5 lacs.

Financial Analysts study the data and formulate recommendations aimed at making investment decisions. They track financial trends, market conditions, and company performance to recommend investment strategies. The average annual salary for financial analysts in India is ₹ 6 lacs.

Credit Analysts are professionals who analyze bonds and default risk. They focus on credit quality analysis of various borrowers and investment potential. The average salary per annum for a Credit Analyst in India is Rs. 8 Lacs.

Equity Analysts measure how well investments and management do in terms of stock price and market trends. The analysis is then useful in investment decisions and performance forecasting. The average salary per annum for an Equity Analyst in India is Rs. 7.2 Lacs.

Chief Investment Officers manage investment strategies and portfolios for businesses or organizations and are also part of executive-level employees. The average salary of a CIO in India is around 60 lacs annually.

A Relationship Manager not only builds trust but also maintains it with the customer. They capture opportunities and suggest products or services that are appropriate for growing those numbers of customers and revenue. In India, their average salary is 5 Lacs per annum.

The demand for CFA charter holders in India is strong, with top employers such as

CFAs make up between 1% to 6% of the workforce, with opportunities ranging from entry-level to mid-level and executive positions.

So if you want to join our CFA Course in Surat, contact us today.

Here, at edZeb, we train students to become CFA professionals and achieve high distinction in the world of finance. Our CFA classes in Surat are led by CA Vikas Vohra. He is a chartered accountant (CA) and has about a decade of experience in the finance stream. CA Vikas Vohra has garnered insights through firsthand industry experience and mentoring over 10,000 students in PAN India.

He continues to aid students 24/7 through personalized mentorship, giving them practical insights from his industrial experience. His passion for student success ensures that students are held hand in hand towards success. It helps them pass their CFA examinations with flying colours and has a promising career in finance.

Our CFA faculty uses emerging methods of teaching to make the toughest of concepts simple. We also impart experiential knowledge during the class. Our aim behind it is to empower our students to win in corporate challenges when theoretical knowledge has to be put into action.

CA Vohra is an invaluable resource in the field of financial education due to his wide range of expertise and dedication towards training. He provides case studies, assistance, and perceptive information which enhances students' knowledge of this vertical.

edZeb promises guidance, support, and mentoring to achieve the career aspirations of their students and encourages them to take Level I and Level II CFA classes in Surat. Apart from this, edZeb also offers CFA coaching in Mumbai to hone finance and accounting skills.

At edZeb, we bring world-class CFA coaching in Surat, equipping aspiring finance professionals with structured training, expert mentorship, and real-world applications. We welcome doubts along with welcoming students' reviews and testimonials equally. Enrolling at edZeb is a smart choice for advancing your career. We offer practical exposure to accounting, budgeting, and forecasting at our CFA institute in Surat. This makes them an ideal partner for your CFA journey.

We prepare our students with a goal in mind to help them pass their CFA exam and also teach them much-needed industrial knowledge and skills. Our standard record is that our passing rate exceeds 90% for CFA Level I and Level II vs a global pass rate of 40%.

edZeb recognizes that student's primary goal is finding a lucrative, well-respected job, and thus, we have a dedicated placement cell to offer placement assistance to CFA students.

At CFA Institute in Surat, our teaching staff comes with 75 years of combined experience. They are skilled professionals dedicated to providing individualized support and excellent instruction to each student.

Our comprehensive CFA syllabus covers fundamental concepts to complex topics, offering online, live, and weekend classes. At CFA coaching in Surat, we also offer study materials, practice exams, and interactive learning tools to prepare students for exams.

Our CFA course in Surat offers personalized attention, support, and tools to help students prepare for success. We provide comprehensive study materials, practice tests, LMS, KICN teaching methodology, placement assistance, and more.

Our interactive LMS feature allows access to pre-recorded lectures, mock test series, online classes, and progression reports. We ensure a high success rate for both offline and online learning.

Our best CFA coaching in Surat equips students with essential knowledge and skills for success in the accounting and finance industries. We emphasize practical, real-world applications to prepare graduates for industry demands.

Our mentors follow the basic rule, which is KICN (Knowledge Integrated with Corporate Needs), an education methodology designed to bridge the gap between academic learning and industry requirements.

Therefore, book your counselling session with our senior counsellors today and learn about our best CFA coaching center in India to start your journey. In addition to this, we also provide a CFA course in Delhi as well, so book your seat today.

edZeb is a leading provider of the best CFA coaching in Surat, tailored to individual learning styles and schedules. Students can schedule consultations with top counsellors and contact them with any questions. Our CFA classes in Surat also offer an interactive LMS with recorded lectures, live lectures, mock exams, and question sessions.

The trainers help students pass exams and secure high salaries through numerous career prospects in India and overseas. Many of our students have passed their CFA exams with flying colours. As a result, this leads to employment by prestigious companies worldwide.

We are committed to supporting students every step of the way in our CFA course in Surat, from initial preparation to achieving the prestigious CFA designation. So, wait no more, contact us now.